Table of Content

Scalping is a strategy used in the forex market. It enables traders to capitalize from price fluctuations within a short period of time. As a result, traders rush to make trades of milliseconds or seconds, and a trader sweeps several pure buys and sells with little spread in a single trading day.

This article explores the fundamentals of forex scalping, including how it works, essential tools and skills, pros and cons, and practical strategies for traders interested in this approach.

What is Forex Scalping?

Forex scalping involves taking advantage of net currency pair movements for quick cash. Instead of keeping positions open for several hours, days, or even weeks like swing or position traders tend to do, scalpers execute many trades during a single trading session. The focus is on small gains (measured in pips) that can accumulate over time.

Characteristics of Scalping:

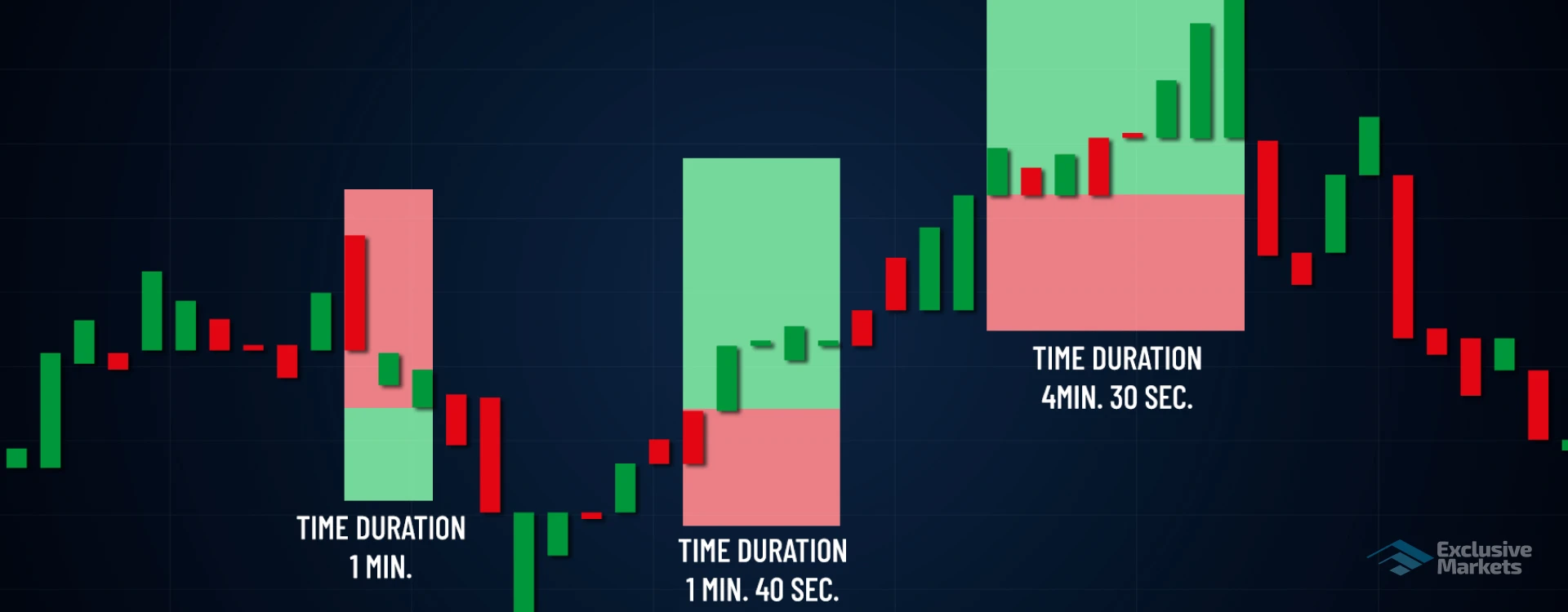

Short Holding Periods: Trades are taken and issued in milliseconds or minutes.

High Trading Frequency: Scalpers may execute dozens to hundreds of trades daily.

Small Profit Margins: The profit accrued from each trade is small, often just a few pips.

High Leverage Usage: Many scalpers use leverage to amplify potential gains but must be cautious of the risks involved.

Liquidity Drain: Scalping requires high market liquidity to ensure quick execution and minimal spreads.

How Does Scalping Works?

Scalping itself depends on the insight that small price changes occur often. The whole mechanics goes like this:

Choosing a Currency Pair: Scalpers focus on major currency pairs like EUR/USD, GBP/USD, or USD/JPY due to their inherent high liquidity and tight spreads.

Use Technical Analysis: Scalpers often rely on technical indicators like moving averages, Bollinger Bands, and RSI for entry and exit point signals.

Placing Orders: Trades are executed based on strategies such as breakouts or trend-following.

Quick Execution: Trades are taken and issued almost instantaneously to avoid exposing oneself to unpredictable fluctuations in the market.

Risk Management: Stop-loss orders are critical for limiting a trader's exposure to substantial losses due to unexpected price changes.

Tools and Techniques required for Scalping

Successful scalping demands specific tools and techniques. Some of them are listed as follows:

-

Trading Platform

Scalping depends on speed and reliability, so a trading platform has to be fast and reliable. Scalpers tend to employ platforms like MetaTrader 4 or MetaTrader 5 because they are speedy, customizable, and have advanced charting abilities.

-

Technical Indicators

Other popular indicators used in scalping are Moving Averages, which provide trends and signals for entry; Bollinger bands, which signal price volatility and potential breakout areas; and the Relative Strength Index (RSI), which indicates an overbought or oversold situation. The Stochastic Oscillator, which shows price momentum and reversals, is another popular indicator.

-

Economic Calendar

Scalpers avoid trading during big economic news releases. A financial calendar tracks significant events.

-

Risk Management Tools

It is important to use a tight stop-loss and take-profit level. Scalpers mainly use position sizing calculators to decide the trade size according to their risk tolerance.

-

Automated Trading

This is an advanced type of FX scalping in which Expert Advisors (EAs) or algorithmic trading systems automatically place trades based on established criteria.

Best Strategies for Forex Scalping

Various strategies can be implemented for forex scalping. The choice of a strategy depends on the trader's individual preferences with respect to other factors like risk appetite and market conditions.

Trend Scalping involves identifying the ongoing trend in the market and, accordingly, taking trades in that direction. Indicators like moving averages and trendlines are frequently used to detect trends.

Range Scalping: Scalpers range-trade when the market is declining and consolidated within a price range. Support and resistance points play a vital part in this strategy.

Breakout Scalping: Traders look for price breakouts above or below key support and resistance levels. A price breakout usually leads to a swift and unforeseen price move, giving traders an opportunity for a fast profit.

News-Based Scalping: Scalping capitalizes on price movement triggered by an announcement or news. It requires fast decisions and execution to seize the volatility.

Note: This approach carries higher risk.

Scalping with Indicators: More indicators can lead to other different clarifications.

Best Indicators for Scalping

To scalp forex effectively, you can rely on best trading indicators that offer fast execution opportunities during each trading session. Here are some key tools:

-

RSI (Relative Strength Index)

This measures market momentum, ranging from 0 to 100. A reading below 30 suggests the market is oversold, while a value above 70 points to an overbought condition.

RSI (Relative Strength Index) -

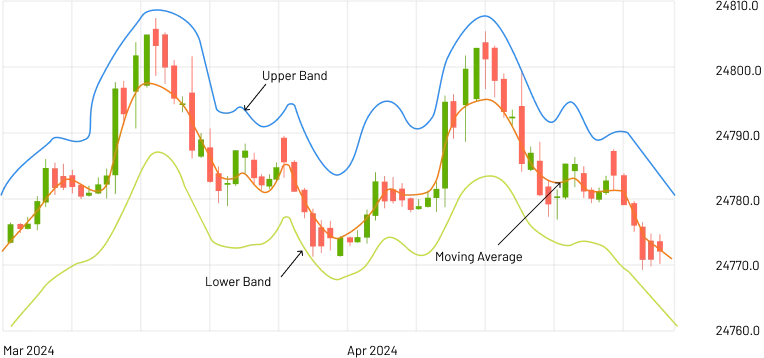

Bollinger Bands

These bands highlight market volatility. When prices break through the outer bands, it could indicate a potential trade setup.

Bollinger Bands -

Stochastic Oscillator

This compares a forex pair's closing price to its recent price range, providing insights into momentum with a value between 0 and 100.

Stochastic Oscillator -

Moving Averages

Moving average crossovers can signal potential trend changes, while the MACD helps identify new trade signals.

Moving Averages

However, you can also scalp without indicators. Some traders prefer using price action, analyzing candlestick chart patterns that often predict specific price movements.

Advantages of Forex Scalping

Forex scalping has numerous advantages that captivate traders:

Instant Profits: Scalpers earn quick profits and do not maintain open positions overnight like other traders.

Limited Exposure: The short-lived stages of the trade limit risks are inflicted by unexpected market events.

High-frequency Trades: High-frequency trades will lead to numerous pockets of profit during the day.

Suits Active Traders: It works best for traders who imagine quick-paced and fast-action trading.

Compounding Little Gains: Many small consistent profits may add up to a substantial profits somewhere along the line.

Challenges & Risks of Forex Scalping

Several unique challenges and risks accompany scalping:

Highly Stressful: The fast pace of scalping makes it a highly stressful and tiring engagement.

Transaction Costs: High-frequency transactions result in huge costs arising from spreads and commissions that cut deep into profits.

Speed-dependent: Success in scalping requires swift decisions and execution. If an internet connection or platform is slow, opportunities may be lost.

High-leverage Risk: It increases profit gain and the possibility of significant losses.

Market Noise: Short-term price movement can be chaotic and triggered or influenced by random noise, making it difficult to predict the outcome precisely.

Forex Scalping Tips for Beginners

Choose a Reliable Broker: Choose a broker that offers tight spreads, low commissions, and fast order execution.

Start Small: Begin with a demo account or small position sizes to practice and refine your strategy.

Stick to Liquid Pairs: Focus on popular currency pairs for better liquidity and lower transaction costs.

Set Realistic Goals: Aim for consistent, small profits rather than chasing significant gains.

Maintain Focus: Scalping requires undivided attention. Eliminate distractions during trading sessions.

Optimize Your Trading Setup: Use multiple monitors and high-speed internet to stay updated on market movements.

Review Your Performance: Regularly analyze your trades to identify strengths and areas for improvement.

Conclusion

Forex scalping is a dynamic and challenging trading strategy that offers the potential for quick profits by capitalizing on small price movements. While the strategy requires technical skills, discipline, and the right tools, it also carries inherent risks. Traders should approach scalping with caution, understanding their risk tolerance and market conditions.

By adopting a well-structured plan and focusing on consistent performance, scalpers can determine whether this strategy aligns with their trading objectives.

Are you Ready to Explore the World of Trading?

Disclaimer: The information provided on this blog is for educational/informational purposes only and should not be considered financial/investment advice. Trading carries a high level of risk, and you should only trade with capital you can afford to lose. Past performance is not indicative of future results. We do not guarantee the accuracy or completeness of the information presented, and we disclaim all liability for any losses incurred from reliance on this content.

6362

6362 27-05-2025

27-05-2025