Table of Content

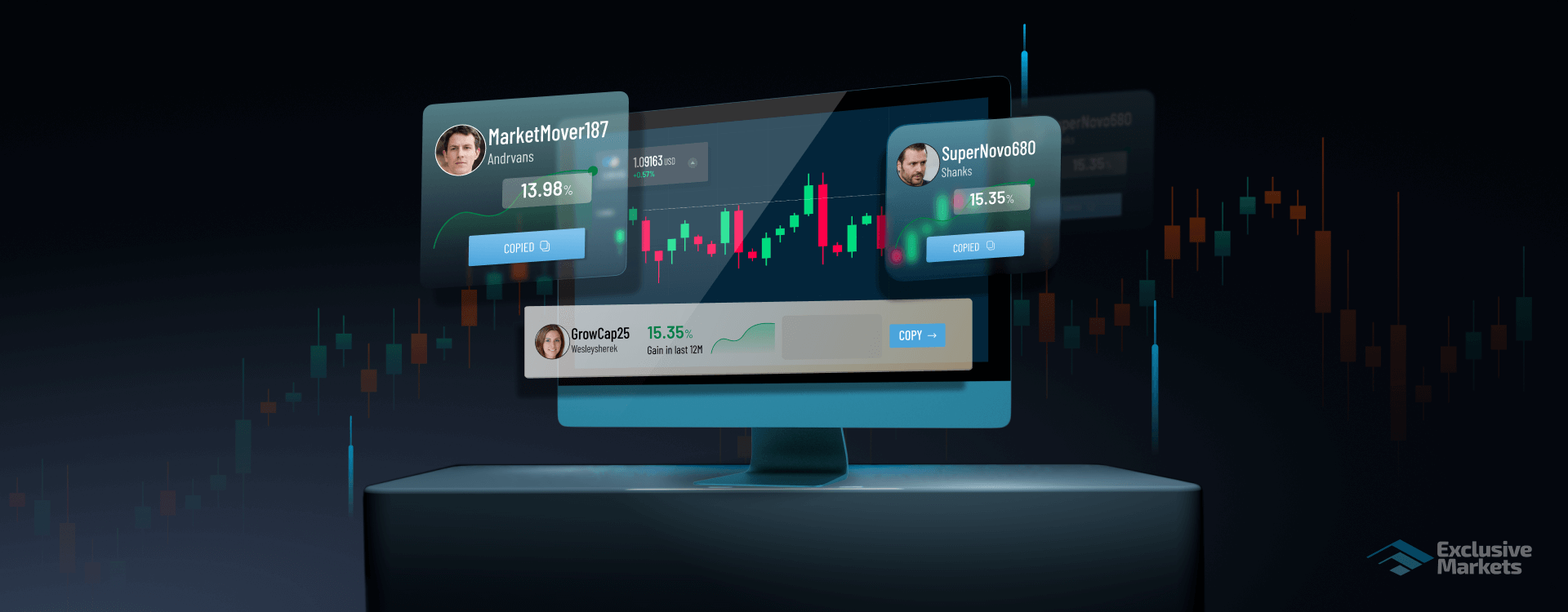

The revolutionary phenomenon of copy trading has just surfaced in the world of investment. Using copy trading, investors can automatically replicate the real-time trades of other traders. This is different from traditional investment approaches. This novel approach not only makes investing easier for beginners but also presents a special chance for experienced traders to benefit from their trading knowledge.

According to various references, the idea of copy trading has become very popular and has changed the way people interact with the financial markets. The best copy trading platforms offer accessibility and possible profitability that are attracting more and more investors, regardless of experience level.

Given the growing popularity of copy trading, selecting the right platform is essential. When copy trading aligns with an investor's investing goals, risk tolerance, and preferences, it functions optimally. To help readers navigate the complex world of copy trading platforms, this article explores important considerations for all types of investors, regardless of their experience. Investors who understand these aspects could maximise returns and minimise risks by making well-informed decisions.

Understanding Copy Trading Platforms

A Copy trading platform provides a revolutionary approach to investing by allowing users to automatically replicate the trades of copy trading providers. In essence, copy trading transforms the financial landscape into a collaborative and interconnected community where knowledge and expertise are shared seamlessly.

Some of the key features of the copy trading platforms include:- Automated Replication: Customers can copy the trading patterns of copy trading providers, sometimes referred to as traders or signal providers. Without requiring manual intervention, this automation results in quick trade completion.

- Diversification: By exposing themselves to a range of assets and trading techniques, investors may easily diversify their portfolios. A large variety of products, such as stocks, currencies, commodities, and cryptocurrencies, are frequently offered by the top copy trading platforms.

- User-Friendly Interfaces: These platforms have been created with user accessibility in mind. They include user-friendly interfaces that make it easy for investors to explore and make efficient use of the platform.

- Performance Metrics: Copy trading platforms are known for their transparent performance metrics, which give investors important information about the past track records of signal providers. These metrics aid users in making informed decisions when selecting traders to follow.

Different Types of Copy Trading Platforms

- Social Trading Networks: The main objective of social trading networks is to establish a

cooperative society in which investors may communicate, exchange ideas, and gain knowledge from one another.

A few of the important characteristics are as follows:

- User Interaction: Within the platform's social network, traders can communicate, exchange trading concepts, and discuss strategies.

- Leaderboards and Rankings: To make it simple for customers to identify top-performing traders, platforms frequently include leaderboards that rank signal providers according to their performance.

- Community Sentiment: A summary of the market sentiment within the community is provided by certain platforms that integrate sentiment analysis techniques.

- Automated Trading Platforms: These platforms use technology and algorithms to execute trades

for investors.

Some of the noteworthy features are:

- Algorithmic Strategies: To automate buy and sell decisions, these platforms make use of pre-established algorithms and trading strategies.

- Risk management: To regulate exposure, set stop-loss levels, and manage overall portfolio risk, automated platforms frequently come with risk management capabilities.

- Back testing capabilities: Through back testing, traders can evaluate the past performance of algorithms, enabling optimisation and improvement.

Advantages Associated with Copy Trading

The following are a few advantages of copy trading:

- Accessibility: Even with limited financial expertise, traders can engage in the financial markets.

- Time-Efficiency: Without spending a lot of time on market research and analysis, investors have the chance to profit from the experience of others.

- Diversification: By distributing investments among a variety of assets and trading philosophies, copy trading lowers total risk.

Potential Risks Associated with Copy Trading

The following are a few risks related to the copy trading:

- Market Risks: Even with automated execution, copy trading is still vulnerable to unanticipated occurrences and market volatility that could affect the financial markets.

- Dependency on Signal Providers: Investors that use copy trading are at the mercy of signal providers' performance and choices. Besides this, it is crucial to understand their strategies and risk tolerance.

- Over-Reliance on Past Performance: Historical performance is not a guarantee of future success. When selecting signal providers, investors should be cautious while relying solely on historical performance metrics.

Key Factors When Choosing a Copy Trading Platform

When selecting a copy trading platform suitable for you, consider some of the important factors:

- Credibility and Reputation

- Track Record: Research the platform's history and performance. Select a trading platform that has a track record of successful trades. However, it’s important to note that successful trades are influenced not just by the platform but also by the effectiveness of the copy trading providers.

- User Reviews: To get a sense of other traders' and investors' experiences, read through customer reviews and testimonials.

- Regulatory Compliance

- Regulatory Oversight: Choose a platform that is regulated by reputable financial authorities. Regulatory compliance ensures a certain level of trust and adherence to industry standards.

- Transparency: Ensure that the platform provides transparent information regarding its regulatory status and compliance measures.

- Available Assets and Markets

- Diversity: Assess the variety of assets and markets offered on the platform. A diverse range allows you to tailor your portfolio to your investment goals and risk tolerance.

- Compatibility: Ensure the platform aligns with your preferred trading instruments and markets.

- Risk Management Tools

- Risk Mitigation: Analyse the risk management capabilities of the platform. Seek resources that enable traders and investors to manage and reduce risk efficiently.

- Risk Disclosure: Ensure that the platform gives clear information to its users about any possible risk related to copy trading.

- Performance Metrics and Transparency

- Comprehensive Metrics: Evaluate whether traders can access complete performance metrics. Transparent reporting of past performance helps in making informed decisions.

- Fee Transparency: Recognise all hidden expenses in the pricing structure. Transparent fee information helps calculate the actual costs of using the platform.

- User Interface and Technology

- Technical Framework: Evaluate the technological capabilities of the platform. A robust infrastructure ensures stability and reliability during trading.

- User-Friendly Interface: Select a trading platform that is user-friendly for both experienced and new traders.

- Social and Community Features

- Communication Channels: Check for efficient means of communication between investors and traders. Social aspects strengthen the collaborative nature of copy trade.

- Community Engagement: Platforms with discussion groups and community forums promote knowledge sharing and a sense of community.

- Price and Fee Schedule

- Fees for Traders and Investors: Understand the fee structure for both traders and investors. Analyse prices on several platforms to guarantee fair and competitive pricing.

- Hidden Costs: Keep an eye out for unstated expenses, including withdrawal fees or additional charges.

- Data protection and Security

- Robust Security Measures: Platforms with strong security features should be given priority if you want to safeguard your money and personal data.

- Policies for Data Protection: Make sure the platform follows industry-recognized encryption procedures and has explicit data protection rules.

- Trial Period & Demo Account

- Practice Environment: Look for platforms offering demo accounts for users to practice without risking real money.

- Trial Period: You can test out the features and functionality of platforms with trial periods before having a longer commitment.

Conclusion

Selecting a copy trading platform for you requires careful consideration. Important factors to consider include asset alignment, regulatory compliance, and reputation. Features like transparent metrics, risk management tools, and an easy-to-use UI increases the platform's appeal.

Are you Ready to Explore the World of Trading?

Disclaimer: The information provided on this blog is for educational/informational purposes only and should not be considered financial/investment advice. Trading carries a high level of risk, and you should only trade with capital you can afford to lose. Past performance is not indicative of future results. We do not guarantee the accuracy or completeness of the information presented, and we disclaim all liability for any losses incurred from reliance on this content.

7745

7745 24-02-2025

24-02-2025